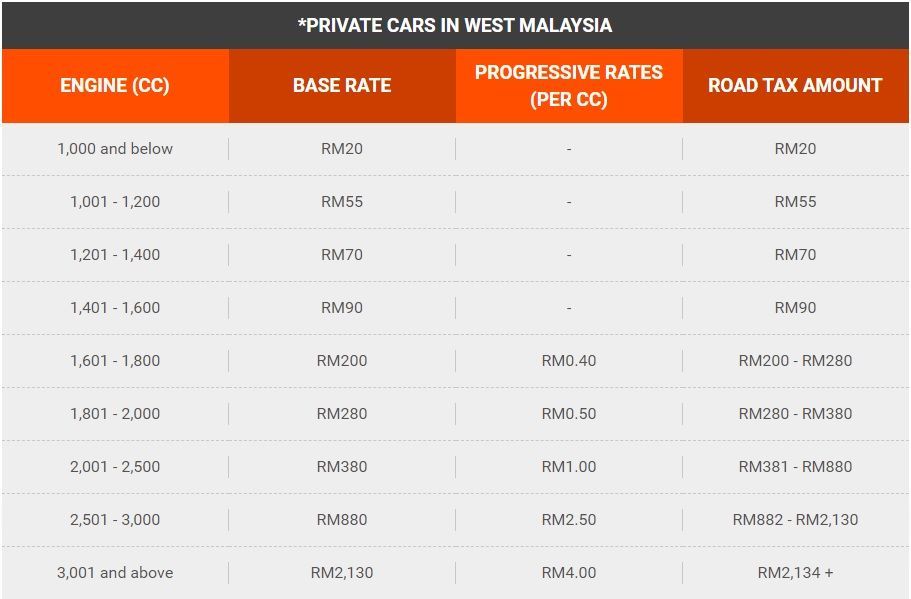

Latest JPJ formula - calculate how much your vehicles road tax will cost. Total of progressive rates Base Rate.

Well lets see how much the road tax for a Proton X70 would cost if it was calculated like an EVs road tax.

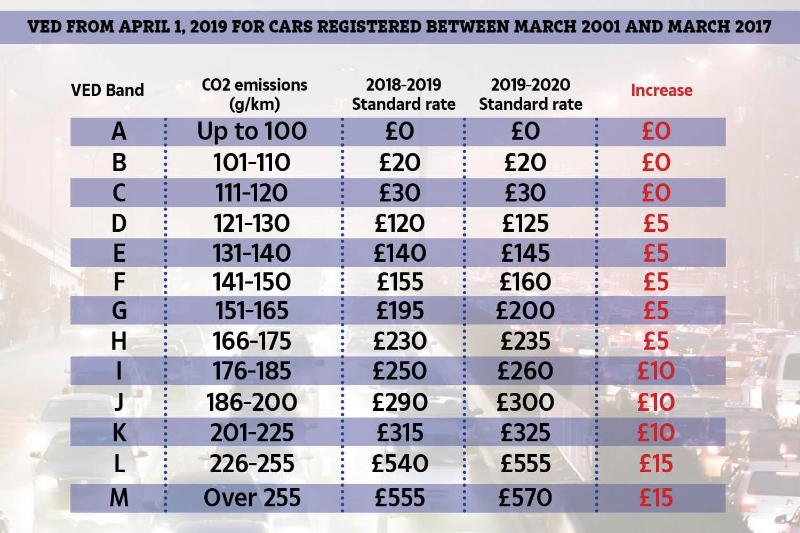

. Progressive rate is capped at RM160 per cc only from 2500 cc onwards while a privately registered saloon car can be levied up to RM450 per cc from 3000 cc onwards. On the First 10000 Next 10000. And that is how you can calculate the.

Latest JPJ formula - calculate how much your vehicles road tax will cost. Do note that recently in Malaysias Budget 2022 the government has. Engine cc Base Rate.

For the past few years Electric Vehicles EV like the Tesla Nissan Leaf and Renault Zoe have been enjoying a very low road tax rate as. Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak is in this link. With an extensive database of new cars on sale in Malaysia.

NEW Road Tax rates for EVs in Malaysia. Road Tax for Private Car and Motorcycle. On the First 2500.

SUVMPVPick-up in East Malaysia road tax. As such total of progressive rate is computed as. Your road tax amount.

Rate TaxRM 0-2500. Anything in excess of 2001 CC is RM100 per CC. Proton X70 135 kW 184 PS With the displacement-based.

Progressive rate per cc Road tax amount. Lets take an example with the above values in mind. RM7960 RM200.

If you register your vehicle with the Road Transport Department they will charge this fee. On the First 5000 Next 5000. Road tax in Malaysia can be renewed both manually and online.

When doing the renewal process manually you would have to purchase an insurance plan prior to renewing your road tax. Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak revised after the 2009 Budget. RM274 base rate Remaining 10kW.

Suppose your electric saloon generates a maximum output of 110 kW then you be paying a. RM 135 above 150 kW. Take example of Hilux 25Gs road tax of RM46036 in Sabah and Sarawak since Hilux has diesel engine and 4WD the road tax is further being reduced ie.

Take the 2354 CC and minus it with the 2001cc in the table below. RM050 progressive rate x 200 RM100. Youll find prices specifications.

According to Malaysian laws all vehicle users have to pay a road tax. So minus 1600cc instead of 1601cc. Total road tax.

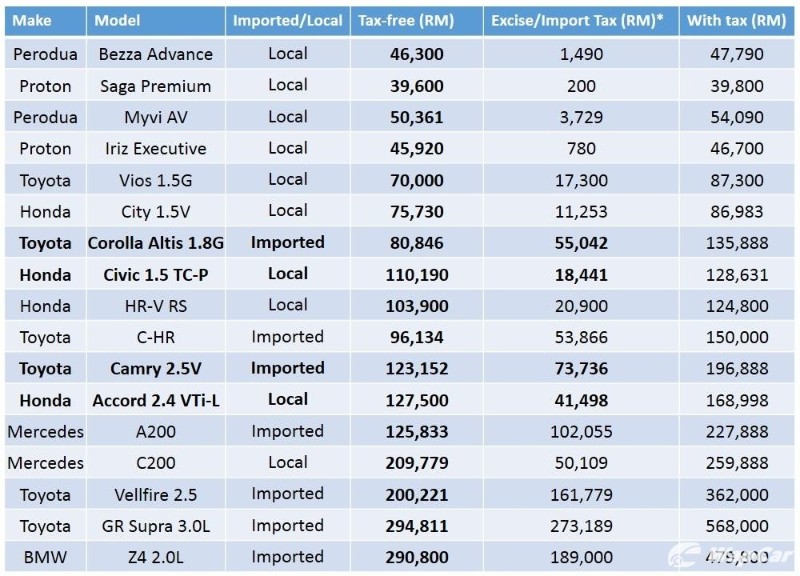

Import duty must be paid on any vehicles imported into Malaysia. These rates can be quite high and excise duties can be up to 100 percent when importing a foreign vehicle.

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Road Tax Malaysia Everything You Need To Know Fatberry Blog

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Road Tax Paid To Jpj Don T Go To Road Maintenance So What Are We Paying For Wapcar

How Do You To Renew Your Insurance And Road Tax Online Wapcar

Topgear Ev Talk Why The New Tesla Model S S Road Tax Would Cost Rm17k In Malaysia

Road Tax 怎么算 马来西亚路税架构解说 Automachi Com

What Determines Roadtax Prices In Malaysia Bjak Malaysia

Kadar Cukai Jalan Road Tax Dan Kalkulator Untuk Kiraan

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Do You Know How Your Road Tax Is Calculated

How Much Do You Know About Malaysian Road Tax Ezauto My

How Much Do You Know About Malaysian Road Tax Ezauto My

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar